FCPO closed : 2709, changed : +39 points, volume : lower.

Bollinger band reading : upside biased.

MACD Histrogram : getting higher, buyer market.

Support : 2700, 2670, 2650 level.

Resistant : 2730, 2750, 2790 level.

Comment :

Thin volume traded FCPO ended today higher with last hour buying activities push price higher break 2700 resistant level. Daily chart still favour a upside biased market with a little overdone price upward movement considering the more that 50% lower volume transacted which could triggered market to have a correction in the near term with crucial resistant ahead at 2730(Jan 2010 high).

When to buy : buy at support/weakness/break up with quick cut loss and profit target.

When to sell : sell at resistant or strength with quick cut loss and profit target.

A place for all traders and investors of Futures Markets.

Monday, March 8, 2010

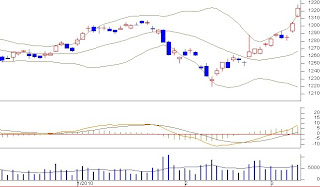

20100308 1748 FKLI EOD Daily Chart Study.

FKLI closed : 1323.5, changed : +20.5 points, volume : higher.

Bollinger band reading : bullish but over extended.

MACD Histrogram : going higher. buyer dominated.

Support : 1315, 1307, 1300 level.

Resistant : 1325, 1335, 1345 level.

Comment :

FKLI hit another new high today followed by partial profit taking pushed FKLI to closed slightly off the high with accelerating volume. All indicators on screen suggesting a bullish outlook. Having said that, today up candle bar closed a little far away from the upper Bollinger band shows that the upward surge has been over extended with possible pullback effect taking place in the near term before the resume upward.

When to buy : buy at support or weakness with quick cut loss and profit target.

When to sell : sell at resistant or strength with quick cut loss and profit target.

Bollinger band reading : bullish but over extended.

MACD Histrogram : going higher. buyer dominated.

Support : 1315, 1307, 1300 level.

Resistant : 1325, 1335, 1345 level.

Comment :

FKLI hit another new high today followed by partial profit taking pushed FKLI to closed slightly off the high with accelerating volume. All indicators on screen suggesting a bullish outlook. Having said that, today up candle bar closed a little far away from the upper Bollinger band shows that the upward surge has been over extended with possible pullback effect taking place in the near term before the resume upward.

When to buy : buy at support or weakness with quick cut loss and profit target.

When to sell : sell at resistant or strength with quick cut loss and profit target.

20100308 1305 FKLI Mid Day Hourly Chart Study.

FKLI closed : 1322, changed : +19 points, volume : high.

Bollinger band reading : bullish.

MACD Histrogram : rising. buyer guarding well.

Support : 1315, 1307, 1300 level.

Resistant : 1325, 1335, 1345 level.

Comment :

Steroid taken FKLI traded today positively with better volume. Needless to elaborate further, whatever technical indicator will be having a bullish further upside potential signal. Having said that, price has been traded near and above the upper Bollinger band for some times since last Friday raise alert for a potential market correction to take place soon.

Bollinger band reading : bullish.

MACD Histrogram : rising. buyer guarding well.

Support : 1315, 1307, 1300 level.

Resistant : 1325, 1335, 1345 level.

Comment :

Steroid taken FKLI traded today positively with better volume. Needless to elaborate further, whatever technical indicator will be having a bullish further upside potential signal. Having said that, price has been traded near and above the upper Bollinger band for some times since last Friday raise alert for a potential market correction to take place soon.

20100308 1240 FCPO Mid Day Hourly Chart Study.

FCPO closed : 2686, changed : +16 points, volume : thin.

Bollinger band reading : upside biased.

MACD Histrogram : getting weaker, buyer taking profit.

Support : 2670, 2650, 2620 level.

Resistant : 2700, 2730, 2750 level.

Comment :

A quiet morning on FCPO that ended the first session a marginally higher duirng the first day of the Malaysia palm oil conference. Hourly chart reading suggest that market is likely to trade side way range bound upside biased.

Bollinger band reading : upside biased.

MACD Histrogram : getting weaker, buyer taking profit.

Support : 2670, 2650, 2620 level.

Resistant : 2700, 2730, 2750 level.

Comment :

A quiet morning on FCPO that ended the first session a marginally higher duirng the first day of the Malaysia palm oil conference. Hourly chart reading suggest that market is likely to trade side way range bound upside biased.

20100308 1153 Malaysia Corporate News.

Genting Singapore’s Resorts World Sentosa (RWS) will open Universal Studios Singapore (USS) to the public on 18 March. Before this, the park’s first guests will be team members of RWS, who will be the first to enjoy USS with their families from 13 March. (Press Release)

The opening date is consistent with management’s mid-March guidance and in line with its phased opening. We expect stronger visitor arrivals after the opening of USS, which is one of RWS’s key attractions.

Emirates has launched a third daily flight from Dubai-Kuala Lumpur and onward to Melbourne from 1 February, with plans to add a few more destinations like Amsterdam, Prague and Madrid in the next couple of months. (BT)

Emirates’ expansion into Melbourne and Amsterdam may compete with MAS’ offerings and create price pressure.

Axiata seems to have smoothed out the rough edges since separating from Telekom Malaysia (TM) to become a regional mobile player and appears to have hit its stride based on the performance of its first full year operating as an individual entity. The key highlights of the interview are:

Sarawak, which is opening up large tracts of land for oil palm cultivation, has emerged as a “hotspot’’ for plantation investors. Big conglomerates like Sime Darby and IOI Corp are among the several new investors in the state’s plantation industry, according to Sarawak Land Development Minister Datuk Dr James Masing. He said the state government had approved more than 720,000 hectares (ha) of native customary rights (NCR) land for oil palm projects to be undertaken by Sarawak, Sabah and peninsula-based plantation companies under the new development model. The approved land in 63 areas more than doubled the total 350,000ha recorded in 2008. He said each NCR joint-venture project would cover a land size of 5,000ha to 20,000ha, of which 65% to 70% of the area was plantable. (Starbiz)

Sime Darby Property's chief is looking to the RM30bn Sime Darby Vision Valley (SDVV) to be its future growth driver. The 32,000ha development is expected to enhance the value of its landbank and the company is optimistic of an earnings margin of no less than 15%. It expects to secure approval for the project soon and for work to start in September, MD Datuk Tunku Putra Badlishah said. The SDVV, scheduled to be completed by 2025, targets housing more than 4.5m people. Tunku Badlishah said that key to the SDVV, a regional development, will be to attract FDIs from Asia-Pacific, the US, Europe and the Middle East. (BT)

PPB Group, which sold its sugar business for RM1.3bn, will return RM592.8m in special dividends to shareholders this year and use the rest of the money to expand its flour and property business. MD Tan Gee Sooi said the sale of the sugar asset was completed on Jan 12 and gains of RM857m were expected to be reflected in the group's 1QFYE12/10 results.

Sabah Electricity Sdn Bhd (SESB) has succeeded in reducing electricity shortage in Tawau by 87.34% from Sept 1, 2009 to Feb 2010. Corporate communication senior manager Chendramata Sinteh said the improved supply was down to installation of mobile 1MW generator sets at Pasir Putih. The long term plan involves IPP Ranhill Powertron (II) which will supply 190MW of electricity by Aug. (Bernama)

Malaysia Airlines yesterday withdrew its US$35.5m civil suit against Air Maldives (AML) filed in the High Court in Kuala Lumpur in 2004 following an agreement reached with the Maldives government two weeks ago. Under the agreement sealed in the Maldives capital Male on Feb 14, the Maldives government withdrew a US$90m claim filed with the Singapore-based International Court of Arbitration on March 1. MAS and AML had earlier entered into a joint-venture agreement via the Maldives Government and Naluri Corp, a corporate vehicle of then MAS chairman Tan Sri Tajudin Ramli. (Bernama, Star)

Malaysia Airlines will be offering an additional two non-stop daily services to its existing five times weekly flights from Kuala Lumpur to Paris, starting this March 28. (Financial Daily)

Star Publications' anticipation of a better performance in 2010 is bolstered by several other factors, such as the introduction of new products and the expectation of continuing improvements in major businesses. "Last year was definitely challenging for the media industry, particularly in the first half, when the weak consumer sentiment had a significant impact on advertising volume. What helped a lot was that we responded quickly and decisively with cost saving measures and a more prudent purchasing policy..." Executive deputy chairman Datuk Clement Hii said. (Star)

Proton has yet to identify the local vendors to supply parts for its concept car, EMAS, which will spearhead its world ambition. Proton will develop a comprehensive local vendor structure to support its global car programme, saying it is important that vendors share its aspirations of becoming a world player. Currently, some 220 vendors supply parts to Proton, but it is expected to identify only 10-15 vendors during the development phase of the EMAS. Proton's director of engineering division, Tajul Zahari Abu Bakar said he was not concerned about the ability of local vendors to produce and supply the parts for the powertrain developed by Lotus. (BT)

The local automated equipment manufacturing sector is facing critical challenges that stem from competition with China-made automated equipment, which are improving by leaps and bounds, and the shortage of quality design engineers in the country. Pentamaster Corp executive chairman said that China was now starting to design higher-end automated equipment with innovative features and competitive pricing for the international market. China-made automated equipment are priced 40% to 50% lower than Malaysia-made units, which are sold in the market at an average of about US$150,000 onwards. (Starbiz)

SP Setia is set to make its mark on Penang's Gurney Drive, if a plan to buy an identified parcel of land measuring 0.92 hectares in the area goes through. It plans to build 70 units of high-end super-condominiums boasting a floor area of 3,000 sq ft. The proposed project in Gurney Drive is part of SP Setia's move to expand its landbank by 12ha this year. "We have also identified another 5.6ha land to acquire in the southwest district of Penang island. We intend to develop a gated community comprising detached and semi-detached homes," Rajoo added. (BT)

Bandar Raya Development is mulling revisiting the option of selling its stake in chipboard maker Mieco Chipboard, says CEO Datuk Jagan Sabapathy. Bandaraya has 56.8% stake in Mieco. The developer has been wanting to dispose of its stake in Mieco for the past four years. It spoke to several local and foreign firms but no firm deal was entered into. MD Datuk Yong Seng Yeow sais Mieco has been in the red because of supply and demand issues, price war, foreign exchange losses and higher operating costs. "We are consolidating to bring down cost. We will hive off some overseas markets if necessary, due to logistics," Yong said. (BT)

Bursa Malaysia has rejected Ho Hup Construction’s application for an extension until March 8 to submit the draft circular related to its plan to sell a plot of land in Bukit Jalil, Kuala Lumpur. Ho Hup said it now plans to submit the draft for Bursa’s approval before issuing it to shareholders in due course. (BT)

Pos Malaysia is investing RM250m to set up a national mail and parcel hub in Shah Alam in its effort to achieve an automation level of up to 70% from 20% currently. The hub will be a processing plant and is expected to be operational by year-end, said its group chief of strategy and planning, Jezilee Mohamad Ramli. The four centres to be closed down are at Daya Bumi, Bukit Raja, Bangi and Seremban, Jezilee said. Logically, Pos Malaysia should have another four to five more plants, however this will depend on the success of the pilot plant, he said. (Bernama)

Pharmaniaga’s manufacturing licence was revoked due to critical findings over the storage and segregation of reject and quarantine materials/products as well as the handling of reject and recalled materials/products. Pharmaniaga said it would present all corrective actions taken to date as well as a plan of action to address the remaining audit issues to the Pharmaceutical Services Division of the Ministry of Health (PSD) on March 8. The percentage contribution of manufacturing to the group’s profit before tax was 23% based on the unaudited results for FYE12/09. (Starbiz)

The opening date is consistent with management’s mid-March guidance and in line with its phased opening. We expect stronger visitor arrivals after the opening of USS, which is one of RWS’s key attractions.

Emirates has launched a third daily flight from Dubai-Kuala Lumpur and onward to Melbourne from 1 February, with plans to add a few more destinations like Amsterdam, Prague and Madrid in the next couple of months. (BT)

Emirates’ expansion into Melbourne and Amsterdam may compete with MAS’ offerings and create price pressure.

Axiata seems to have smoothed out the rough edges since separating from Telekom Malaysia (TM) to become a regional mobile player and appears to have hit its stride based on the performance of its first full year operating as an individual entity. The key highlights of the interview are:

- Axiata at one point was mulling the possibility of selling its tower business in Indonesia, but Jamaludin says there is no longer a need to do so. "If we look from a long-term perspective, we shouldn't sell the towers. From a short-perspective, it looks good because you get cash upfront and the EV multiples are better than our own business. But we're not about the short term," he says. He added,” You sell, but you lose 3-6% in EBITDA margins because you have to pay rent. Currently, we are getting business from other operators. Unless you really need money, you won't sell the towers."

- As for the other mobile operators or OpCos, Jamaludin says the trends observed in the last fiscal year has been heartening although not all of them were equally in trouble, or equally out of the woods yet, especially with respect to both Sri Lanka (Dialog) and Bangladesh (Aktel). Jamaludin expects both of them to be out of the woods by end of this year, which means that both operators will be PAT positive with elements of sustainability with respect to the mobile business. "We're almost there in Bangladesh. Although we are profitable and EBITDA is good, I want to see one or two more quarters to be definite about it," Jamaludin says.

- As for Idea, Jamaludin adds that he is confident that Idea will not be going to shareholders for funds this year, although bidding for 3G is expected to be intense. "Idea itself as a company is in a very good position to fund licence and roll out. It has enough debt capacity and if they really need to, they can sell a stake. And assuming they need the funds, it will not be this year, but next year," he says. In the unlikely event of a cash call in 2011, Jamaludin says Axiata will be in an excellent position to "very easily" fund their 20% portion and retain sufficient funds to pay out dividends. (Edge Weekly)

Sarawak, which is opening up large tracts of land for oil palm cultivation, has emerged as a “hotspot’’ for plantation investors. Big conglomerates like Sime Darby and IOI Corp are among the several new investors in the state’s plantation industry, according to Sarawak Land Development Minister Datuk Dr James Masing. He said the state government had approved more than 720,000 hectares (ha) of native customary rights (NCR) land for oil palm projects to be undertaken by Sarawak, Sabah and peninsula-based plantation companies under the new development model. The approved land in 63 areas more than doubled the total 350,000ha recorded in 2008. He said each NCR joint-venture project would cover a land size of 5,000ha to 20,000ha, of which 65% to 70% of the area was plantable. (Starbiz)

Sime Darby Property's chief is looking to the RM30bn Sime Darby Vision Valley (SDVV) to be its future growth driver. The 32,000ha development is expected to enhance the value of its landbank and the company is optimistic of an earnings margin of no less than 15%. It expects to secure approval for the project soon and for work to start in September, MD Datuk Tunku Putra Badlishah said. The SDVV, scheduled to be completed by 2025, targets housing more than 4.5m people. Tunku Badlishah said that key to the SDVV, a regional development, will be to attract FDIs from Asia-Pacific, the US, Europe and the Middle East. (BT)

PPB Group, which sold its sugar business for RM1.3bn, will return RM592.8m in special dividends to shareholders this year and use the rest of the money to expand its flour and property business. MD Tan Gee Sooi said the sale of the sugar asset was completed on Jan 12 and gains of RM857m were expected to be reflected in the group's 1QFYE12/10 results.

- Tan said the company, which owns one flour factory in Vietnam, plans further expansion in that country.

- PPB Group also plans to commission its first RM105m bakery factory in Pulau Indah, Selangor, by year-end, producing loaf bread and a variety of buns.

- In addition, it will boost its property business, which makes up less than 2% of revenue, by buying more land, mainly in northern Peninsular Malaysia. (BT)

Sabah Electricity Sdn Bhd (SESB) has succeeded in reducing electricity shortage in Tawau by 87.34% from Sept 1, 2009 to Feb 2010. Corporate communication senior manager Chendramata Sinteh said the improved supply was down to installation of mobile 1MW generator sets at Pasir Putih. The long term plan involves IPP Ranhill Powertron (II) which will supply 190MW of electricity by Aug. (Bernama)

Malaysia Airlines yesterday withdrew its US$35.5m civil suit against Air Maldives (AML) filed in the High Court in Kuala Lumpur in 2004 following an agreement reached with the Maldives government two weeks ago. Under the agreement sealed in the Maldives capital Male on Feb 14, the Maldives government withdrew a US$90m claim filed with the Singapore-based International Court of Arbitration on March 1. MAS and AML had earlier entered into a joint-venture agreement via the Maldives Government and Naluri Corp, a corporate vehicle of then MAS chairman Tan Sri Tajudin Ramli. (Bernama, Star)

Malaysia Airlines will be offering an additional two non-stop daily services to its existing five times weekly flights from Kuala Lumpur to Paris, starting this March 28. (Financial Daily)

Star Publications' anticipation of a better performance in 2010 is bolstered by several other factors, such as the introduction of new products and the expectation of continuing improvements in major businesses. "Last year was definitely challenging for the media industry, particularly in the first half, when the weak consumer sentiment had a significant impact on advertising volume. What helped a lot was that we responded quickly and decisively with cost saving measures and a more prudent purchasing policy..." Executive deputy chairman Datuk Clement Hii said. (Star)

Proton has yet to identify the local vendors to supply parts for its concept car, EMAS, which will spearhead its world ambition. Proton will develop a comprehensive local vendor structure to support its global car programme, saying it is important that vendors share its aspirations of becoming a world player. Currently, some 220 vendors supply parts to Proton, but it is expected to identify only 10-15 vendors during the development phase of the EMAS. Proton's director of engineering division, Tajul Zahari Abu Bakar said he was not concerned about the ability of local vendors to produce and supply the parts for the powertrain developed by Lotus. (BT)

The local automated equipment manufacturing sector is facing critical challenges that stem from competition with China-made automated equipment, which are improving by leaps and bounds, and the shortage of quality design engineers in the country. Pentamaster Corp executive chairman said that China was now starting to design higher-end automated equipment with innovative features and competitive pricing for the international market. China-made automated equipment are priced 40% to 50% lower than Malaysia-made units, which are sold in the market at an average of about US$150,000 onwards. (Starbiz)

SP Setia is set to make its mark on Penang's Gurney Drive, if a plan to buy an identified parcel of land measuring 0.92 hectares in the area goes through. It plans to build 70 units of high-end super-condominiums boasting a floor area of 3,000 sq ft. The proposed project in Gurney Drive is part of SP Setia's move to expand its landbank by 12ha this year. "We have also identified another 5.6ha land to acquire in the southwest district of Penang island. We intend to develop a gated community comprising detached and semi-detached homes," Rajoo added. (BT)

Bandar Raya Development is mulling revisiting the option of selling its stake in chipboard maker Mieco Chipboard, says CEO Datuk Jagan Sabapathy. Bandaraya has 56.8% stake in Mieco. The developer has been wanting to dispose of its stake in Mieco for the past four years. It spoke to several local and foreign firms but no firm deal was entered into. MD Datuk Yong Seng Yeow sais Mieco has been in the red because of supply and demand issues, price war, foreign exchange losses and higher operating costs. "We are consolidating to bring down cost. We will hive off some overseas markets if necessary, due to logistics," Yong said. (BT)

Bursa Malaysia has rejected Ho Hup Construction’s application for an extension until March 8 to submit the draft circular related to its plan to sell a plot of land in Bukit Jalil, Kuala Lumpur. Ho Hup said it now plans to submit the draft for Bursa’s approval before issuing it to shareholders in due course. (BT)

Pos Malaysia is investing RM250m to set up a national mail and parcel hub in Shah Alam in its effort to achieve an automation level of up to 70% from 20% currently. The hub will be a processing plant and is expected to be operational by year-end, said its group chief of strategy and planning, Jezilee Mohamad Ramli. The four centres to be closed down are at Daya Bumi, Bukit Raja, Bangi and Seremban, Jezilee said. Logically, Pos Malaysia should have another four to five more plants, however this will depend on the success of the pilot plant, he said. (Bernama)

Pharmaniaga’s manufacturing licence was revoked due to critical findings over the storage and segregation of reject and quarantine materials/products as well as the handling of reject and recalled materials/products. Pharmaniaga said it would present all corrective actions taken to date as well as a plan of action to address the remaining audit issues to the Pharmaceutical Services Division of the Ministry of Health (PSD) on March 8. The percentage contribution of manufacturing to the group’s profit before tax was 23% based on the unaudited results for FYE12/09. (Starbiz)

20100308 1147 Malaysian Economic News.

The country’s new economic model (NEM), which is expected to be unveiled at the end of this month, could have eight key initiatives aimed at achieving a high-income economy, source said. As expected, among the proposed actions plans, which are being firmed up, are strategies:

The international reserves of Bank Negara Malaysia amounted to RM331.8bn (US$96.8bn) as at 25 Feb 10, from RM332.1bn (US$96.9bn) as at mid-Feb. The reserves position is sufficient to finance 10 months of retained imports and is 4.3 times the shortterm external debt. (BNM) Please see our Economic Update for further details

The Domestic Trade, Cooperative and Consumerism Ministry will table a new proposal on the restructuring of the fuel subsidy to the Cabinet soon. Its minister, Datuk Seri Ismail Sabri Yaakob, said the ministry, with cooperation from the Subsidy Rationalisation Lab, would propose the best implementation mechanism to channel all subsidies including fuel, food or infrastructure. "We will also propose to the Cabinet the best suitable methods to curb the purchase of subsidised fuel by foreign nationals," he added. (Bernama)

The government will give emphasis on the development of local manpower so that they can be utilised in the employment sector in efforts to reduce the dependency on foreign labour. Deputy Minister of Human Resources Senator Datuk Maznah Mazlan said that in 2008 there were 2m foreign labourers registered in the country. However, she said the figure dropped to 1.6m in 2009 following the world economic crisis which also affected Malaysia.

- To move towards a high-income economy

- The phasing out of subsidies, which may follow Indonesia’s model of subsidy reforms

- The continued gradual removal of affirmative action policies

- To restrict the employment of foreign workers across all sectors in order for local workers to have more job opportunities

- The measures of “Green” or environmental initiatives The new model is expected to be announced by Prime Minister Datuk Seri Najib Razak at the annual Invest Malaysia conference on 30-31 Mar, will likely pick up where last year’s sweeping reforms left off. (Financial Daily)

The international reserves of Bank Negara Malaysia amounted to RM331.8bn (US$96.8bn) as at 25 Feb 10, from RM332.1bn (US$96.9bn) as at mid-Feb. The reserves position is sufficient to finance 10 months of retained imports and is 4.3 times the shortterm external debt. (BNM) Please see our Economic Update for further details

The Domestic Trade, Cooperative and Consumerism Ministry will table a new proposal on the restructuring of the fuel subsidy to the Cabinet soon. Its minister, Datuk Seri Ismail Sabri Yaakob, said the ministry, with cooperation from the Subsidy Rationalisation Lab, would propose the best implementation mechanism to channel all subsidies including fuel, food or infrastructure. "We will also propose to the Cabinet the best suitable methods to curb the purchase of subsidised fuel by foreign nationals," he added. (Bernama)

The government will give emphasis on the development of local manpower so that they can be utilised in the employment sector in efforts to reduce the dependency on foreign labour. Deputy Minister of Human Resources Senator Datuk Maznah Mazlan said that in 2008 there were 2m foreign labourers registered in the country. However, she said the figure dropped to 1.6m in 2009 following the world economic crisis which also affected Malaysia.

- "We see that there are about 6.5m local labour force with potentials for employment comprising housewives. Of this number, only about 46.0% are involved in the employment sector. If we can raise the figure to 60.0%, we will have potential manpower of more than 1.2m comprising women," she said. (Bernama)

20100308 1142 Global Economic News.

US nonfarm payrolls showed a lost of 36,000 jobs in February, fewer than the 68,000 jobs predicted by the market. The results were still worse than the previous month, as just 26,000 jobs were lost in January, according to a revised estimate. But there was no significant change in the number of unemployed workers, and the unemployment rate held steady at 9.7%. Economists surveyed were expecting an increase to 9.8%. The government said the winter storms that blanketed the East Coast with several feet of snow last month possibly skewed the results. (CNN Money)

US consumer credit increased in January for the first time in a year, with total consumer borrowing rising seasonally adjusted US$5bn (-US$4.6bn in Dec 09), or an annual rate of 2.5% to US$2.456tr. Economists surveyed predicted a decline of US$4.5bn in January. (CNN Money)

Two regional Federal Reserve Bank presidents said they believe the central bank should keep rates low until the recovery picks up. Chicago Fed President Charles Evans told reporters he needs to see signs of “highly sustainable” growth before supporting steps toward tighter monetary policy. St. Louis Fed President James Bullard said that, with the economy at an early stage of renewal, policy makers want to remain “very accommodative.” (Bloomberg)

White House adviser Paul Volcker said it's too soon for US policy makers to withdraw the stimulus measures and interest rate cuts used to fight the worst slump since the Great Depression. “This is not the time to take aggressive tightening action, either fiscally or monetary-wise,” said Mr Volcker, pointing to 'high' unemployment. “So I think we have to, as best as we can, maintain the expectation that it will be taken care of in a timely way.” (SBT)

If President Obama's 2011 budget were put into effect as proposed, the US federal government would add an estimated US$9.8tr to the country's accrued debt over the next decade, according to a preliminary analysis from the Congressional Budget Office (CBO). Of that amount, an estimated US$5.6tr will be in interest alone. By 2020, the agency estimates debt held by the public would reach US$20.3tr, or 90% of GDP. That's up from 53% of GDP in 2009. (CNN Money)

French President Nicolas Sarkozy said the euro region is ready to rescue Greece should the government struggle to fund its budget deficit, arguing that the country is “under attack” from so-called speculators. “I want to be very clear: if it were necessary, the states of the euro zone would fulfill their commitments. There can be no doubt in this regard,” he said. (Bloomberg)

It is too early for Japan to end its massive stimulus spending because the world's second biggest economy is still slowly recovering from a severe recession, the finance minister said. "We actually want to move to an exit strategy soon but it would make things worse’” he said. (Channel News Asia)

A plan by Japan to raise the limit on sales of bills used for currency intervention and accounting for earnings on foreign reserves in yen may offer additional funds for a budget hit by dwindling tax revenues. The borrowing ceiling for the so-called foreign-exchange special account will be lifted by ¥5tr (US$56bn) to ¥145tr for the next fiscal year should the parliament approve the proposed 2010 budget. (Bloomberg)

Chinese central bank governor Zhou Xiaochuan said the nation should be careful in exiting anti-crisis policies, suggesting that the government may not let the yuan appreciate soon against the dollar. “We must be very cautious about the timing of normalising the policies, and this includes the renminbi rate policy. A global recovery isn’t solid,” he said. (Bloomberg)

Top Chinese officials said the nation’s trade surplus is shrinking and urged caution in exiting crisis policies, suggesting that the yuan may not appreciate soon against the dollar. The surplus slid by a total 50.2% yoy in January and February, Commerce Minister Chen Deming said. (Bloomberg)

China plans to nullify all guarantees local governments have provided for loans taken by their financing vehicles as concerns about credit risks on such debt surges. The Ministry of Finance will also ban all future guarantees by local governments and legislatures in rules that may be issued as soon as this month, said Yan Qingmin, head of the banking regulator’s Shanghai branch. (Bloomberg)

China said it could take up to three years for its exports to return to pre-financial crisis levels, as the Asian powerhouse shifted its focus to domestic demand. "Our exports have just started growing again. We will need 2-3 years (for exports) to get back to 2008 levels," said commerce minister Chen Deming. He warned the world economy was not yet on a secure footing and it was "too early to say" demand for Chinese exports would grow this year. (Channel News Asia)

Taiwan’s consumer prices rose 2.4% yoy in February (0.3% in Jan) for a second consecutive month as increased demand during the Lunar New Year holiday drove up food and transportation costs. Market projected for a 2.1% gain. (Bloomberg)

Thailand’s foreign-exchange reserves rose 0.9% to US$141.8bn in the week ended 27 Feb, from US$140.6bn a week earlier. The central bank’s holdings of forward contracts fell 5.3% to US$12.5bn in the same period, from US$13.2bn a week earlier. (Bloomberg)

Philippine inflation increased 4.2% yoy in February (4.3% in Jan), which stayed above 4.0% for a third month as oil and food costs rose, putting pressure on the central bank to further withdraw monetary stimulus. Economists forecast it would rise by 4.3% in February. (Bloomberg)

The Singapore Tourism Board forecast visitor arrivals of 11.5m to 12.5m this year, with tourism receipts of S$17.5bn to S$18.5bn. (Bloomberg)

US consumer credit increased in January for the first time in a year, with total consumer borrowing rising seasonally adjusted US$5bn (-US$4.6bn in Dec 09), or an annual rate of 2.5% to US$2.456tr. Economists surveyed predicted a decline of US$4.5bn in January. (CNN Money)

Two regional Federal Reserve Bank presidents said they believe the central bank should keep rates low until the recovery picks up. Chicago Fed President Charles Evans told reporters he needs to see signs of “highly sustainable” growth before supporting steps toward tighter monetary policy. St. Louis Fed President James Bullard said that, with the economy at an early stage of renewal, policy makers want to remain “very accommodative.” (Bloomberg)

White House adviser Paul Volcker said it's too soon for US policy makers to withdraw the stimulus measures and interest rate cuts used to fight the worst slump since the Great Depression. “This is not the time to take aggressive tightening action, either fiscally or monetary-wise,” said Mr Volcker, pointing to 'high' unemployment. “So I think we have to, as best as we can, maintain the expectation that it will be taken care of in a timely way.” (SBT)

If President Obama's 2011 budget were put into effect as proposed, the US federal government would add an estimated US$9.8tr to the country's accrued debt over the next decade, according to a preliminary analysis from the Congressional Budget Office (CBO). Of that amount, an estimated US$5.6tr will be in interest alone. By 2020, the agency estimates debt held by the public would reach US$20.3tr, or 90% of GDP. That's up from 53% of GDP in 2009. (CNN Money)

French President Nicolas Sarkozy said the euro region is ready to rescue Greece should the government struggle to fund its budget deficit, arguing that the country is “under attack” from so-called speculators. “I want to be very clear: if it were necessary, the states of the euro zone would fulfill their commitments. There can be no doubt in this regard,” he said. (Bloomberg)

It is too early for Japan to end its massive stimulus spending because the world's second biggest economy is still slowly recovering from a severe recession, the finance minister said. "We actually want to move to an exit strategy soon but it would make things worse’” he said. (Channel News Asia)

A plan by Japan to raise the limit on sales of bills used for currency intervention and accounting for earnings on foreign reserves in yen may offer additional funds for a budget hit by dwindling tax revenues. The borrowing ceiling for the so-called foreign-exchange special account will be lifted by ¥5tr (US$56bn) to ¥145tr for the next fiscal year should the parliament approve the proposed 2010 budget. (Bloomberg)

Chinese central bank governor Zhou Xiaochuan said the nation should be careful in exiting anti-crisis policies, suggesting that the government may not let the yuan appreciate soon against the dollar. “We must be very cautious about the timing of normalising the policies, and this includes the renminbi rate policy. A global recovery isn’t solid,” he said. (Bloomberg)

Top Chinese officials said the nation’s trade surplus is shrinking and urged caution in exiting crisis policies, suggesting that the yuan may not appreciate soon against the dollar. The surplus slid by a total 50.2% yoy in January and February, Commerce Minister Chen Deming said. (Bloomberg)

China plans to nullify all guarantees local governments have provided for loans taken by their financing vehicles as concerns about credit risks on such debt surges. The Ministry of Finance will also ban all future guarantees by local governments and legislatures in rules that may be issued as soon as this month, said Yan Qingmin, head of the banking regulator’s Shanghai branch. (Bloomberg)

China said it could take up to three years for its exports to return to pre-financial crisis levels, as the Asian powerhouse shifted its focus to domestic demand. "Our exports have just started growing again. We will need 2-3 years (for exports) to get back to 2008 levels," said commerce minister Chen Deming. He warned the world economy was not yet on a secure footing and it was "too early to say" demand for Chinese exports would grow this year. (Channel News Asia)

Taiwan’s consumer prices rose 2.4% yoy in February (0.3% in Jan) for a second consecutive month as increased demand during the Lunar New Year holiday drove up food and transportation costs. Market projected for a 2.1% gain. (Bloomberg)

Thailand’s foreign-exchange reserves rose 0.9% to US$141.8bn in the week ended 27 Feb, from US$140.6bn a week earlier. The central bank’s holdings of forward contracts fell 5.3% to US$12.5bn in the same period, from US$13.2bn a week earlier. (Bloomberg)

Philippine inflation increased 4.2% yoy in February (4.3% in Jan), which stayed above 4.0% for a third month as oil and food costs rose, putting pressure on the central bank to further withdraw monetary stimulus. Economists forecast it would rise by 4.3% in February. (Bloomberg)

The Singapore Tourism Board forecast visitor arrivals of 11.5m to 12.5m this year, with tourism receipts of S$17.5bn to S$18.5bn. (Bloomberg)

Subscribe to:

Comments (Atom)